Did you know you have an Insurance Score? No? Let us inform you, then.

Insurance Score Defined:

Your Insurance Score is not the same as your Credit Score, though it does factor into it.

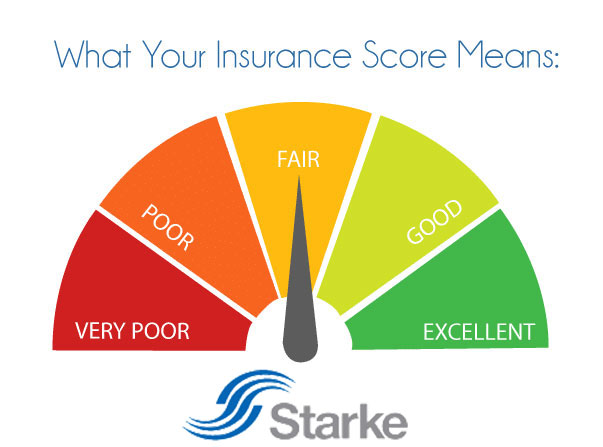

Similar to a credit score, it is calculated by examining factors such as credit history, performance, debt level and the number of attempts to receive credit. Also like a credit score, a higher insurance score indicates a lower risk.

Insurance scores exist to help insurance companies to predict how probable you may be to file a claim and has a direct impact on your premium.

How your Insurance Score is calculated:

Aside from demographical information like age, gender, income, etc.—all of which factor into the equation that determines your rates—what is most important to insurers is your insurance score. In calculating your score, many things are taken into consideration: your credit score, the number of insurance claims you have made, MVR points, your timeliness with payment and credit inquiries, to name a few. Insurers use this score in part to determine whether or not they should take on the risk of insuring you.

Is it fair?

Studies have shown a direct correlation between a person’s credit and the chances of him or her filing a claim. Those with poorer credit history are generally more likely to file insurance claims, so they will often pay more than the average Joe for their insurance rates. Likewise, people with excellent credit history are usually less likely to file insurance claims and will often be rewarded with lower-than-average rates.

Many people don’t like the fact that their credit scores are being used as an underwriting factor for their car insurance rates. So, The Federal Trade Commission did some investigating and issued a congressionally mandated report examining credit-based insurance scores.

How to find your Insurance Score:

FICO and LexisNexis are the most well-known developers of insurance scores. FICO insurance scores range from 300 to 900 and LexisNexis scores range from 300 to 997. Much like your credit score, to find out your insurance score you may have to dish out some cash. LexisNexis sells you your score for $12.95.