The coronavirus also known as COVID-19 that affects the immune system and lungs took its first victim in Wuhan, China on January 11, 2020.

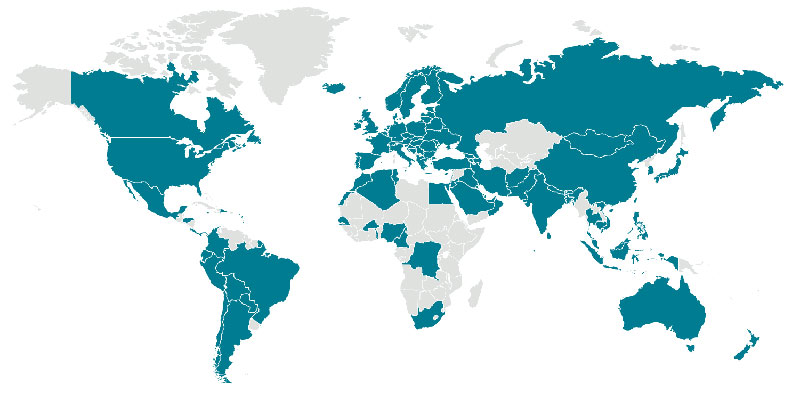

Since then, it has spread worldwide. Affecting mostly those with compromised immune systems, kids and seniors.

The World Health Organization (WHO) declared the outbreak a pandemic since the COVID-19 Virus has killed more than 4,000 people.

The Dow has officially entered bear market after the virus was declared a pandemic. The investments that insurers rely on to pay out claims are withering. Most insurers have 50% of their assets in bonds whose values are falling. The stock market has taken around $11 trillion off the value of global stocks. They are having to put aside more capital for future payouts to policyholders, which puts a dent in their security levels.

The pandemic is affecting people and businesses worldwide. Businesses are putting production on halt. Schools are closing down and the travel industry is taking a huge cut. Airlines are estimated to lose 70% of revenue in the second quarter.

So, what does this mean for us, or you? It means an evaluation of policies and their coverages and exclusions in relation to viruses, bacteria, etc.

The number one type of coverage that could come into play is Business Interruption (BI) policy.

Traditional BI policies require “direct physical loss to property”. Many forms also contain a disease and virus exclusion. However, if a business shuts down due to contamination of the physical facility due to coronavirus, it may have to employ new legal theories as to what is a “direct physical loss”.

An exclusion pulled from a policy of one of our clients reads: “Any virus, bacterium, or other micro-organisms that induces or is capable of inducing physical distress, illness or disease”.

In a recent Insurance Journal audio interview, Wilson Elser Partner Paul White said, “there is almost no aspect of the insurance business that would not be impacted by a global pandemic”.

Insurers are having to assess exposure to the virus via different policies, including: Business Interruption, General Liability, Credit Insurance, Travel Insurance, Event Insurance and Employers Liability on Worker’s Comp.

As the coronavirus continues to affect individuals, businesses, countries, and markets across the globe, it is important that companies act promptly to assess their coronavirus-related risks and develop a response to employees, customers and business assets.

For example, Worker’s compensation policies contain coverage for employers liability which covers “occupational disease”. Occupational disease requires two tests to trigger coverage and most experts believe the two legal tests are not being met.

We at Starke are already feeling the pressure dealing exclusions within policies and how we can respond to them and inform clients. Please visit the Independent Agent’s Association article here for more detailed information.

“We’re in the midst of coverage disputes and having to tell clients that their policies have exclusions for virus and bacteria,” said Kyle Drumwright, Vice President of Surety & Construction of Starke Agency.

The best thing we can do is to communicate with employees and clients about sanitation in the workplace and avoid coming in sick or bringing a sick child to work with you. Working from home if it’s an option and to communicate with clients about the potential risk. The CDC has provided an Interim Guidance for Businesses and Employers in regards to Coronavirus Disease 2019 (COVID-19).

It is important to know moving forward that there is much uncertainty and in our professional opinion insurance will not solve the problems many are facing.